Table of Contents

- Executive Summary: 2025 Outlook and Industry Pulse

- Market Size, Growth Projections & Forecasts to 2030

- Key Players & Recent Partnerships: Leaders in Innovation

- Breakthroughs in Quantum Well Photodetector Design and Materials

- Manufacturing Processes: Advancements & Cost Reduction Strategies

- Application Spectrum: Telecom, Medical, Automotive, and Beyond

- Supply Chain Analysis: From Wafer Fabrication to Module Assembly

- Regulatory Environment & Industry Standards (Referencing ieee.org)

- Investment Trends, M&A, and Funding Opportunities

- Future Outlook: Technological Roadmaps & Competitive Landscape

- Sources & References

Executive Summary: 2025 Outlook and Industry Pulse

In 2025, the wavelength-quantum well photodetector (QWP) manufacturing sector is experiencing notable momentum, driven by the expanding demand for high-sensitivity photodetection across telecommunications, environmental monitoring, and defense applications. Quantum well photodetectors, leveraging the tunable electronic properties of semiconductor heterostructures, are increasingly favored for their enhanced responsivity and selectivity in mid-infrared and terahertz wavelength ranges.

Key manufacturers such as Hamamatsu Photonics and VIGO Photonics continue to scale up production of advanced QWP devices, integrating state-of-the-art epitaxial growth methods—primarily molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD). These techniques are critical for fabricating the precisely layered semiconductor structures that underpin wavelength-specific performance. For instance, Hamamatsu Photonics is expanding its product lineup to include quantum well infrared photodetectors (QWIPs) with tailored spectral responses for industrial and scientific instrumentation.

Recent industry developments highlight a trend toward monolithic integration of QWPs with readout integrated circuits (ROICs) and advanced packaging solutions. This integration is aimed at improving device robustness, reducing noise, and enabling miniaturization—key requirements for portable sensing and next-generation imaging platforms. VIGO Photonics, for example, has announced new investments in automated assembly lines to boost throughput and support emerging applications such as autonomous systems and spaceborne sensing.

From a supply chain perspective, the sector faces persistent challenges related to the procurement of ultra-high purity materials and the need for extreme precision in layer thickness control. The reliance on specialized compound semiconductors like gallium arsenide (GaAs) and indium gallium arsenide (InGaAs) continues, with suppliers such as AIT Austrian Institute of Technology collaborating with industry to improve wafer quality and reduce defect rates.

Looking ahead, the outlook for 2025 and beyond remains robust. The ongoing rollout of 5G/6G networks and the growth of quantum communications are expected to further stimulate demand for custom-engineered QWPs. Furthermore, government-backed initiatives in the US, EU, and Asia are supporting research into new quantum well architectures—such as those enabling room-temperature operation and multi-band detection. These advancements are likely to translate into broader adoption and new market opportunities for manufacturers, positioning the wavelength-quantum well photodetector industry for sustained expansion in the coming years.

Market Size, Growth Projections & Forecasts to 2030

The market for wavelength-quantum well photodetector (QWPD) manufacturing is experiencing robust momentum as of 2025, driven by growing demand in telecommunications, environmental monitoring, medical diagnostics, and advanced imaging applications. Quantum well photodetectors, known for their tunable wavelength sensitivity and improved quantum efficiency compared to traditional photodetectors, are increasingly integrated into both established and emerging photonics systems.

Leading manufacturers such as Hamamatsu Photonics and Thorlabs have reported expanding production volumes of quantum well and multi-wavelength photodetectors, citing rising orders from data center operators, optical networking companies, and research institutions. In particular, the push toward higher-speed optical data transmission (e.g., 400G/800G) is propelling investment in next-generation photodetector modules. Hamamatsu Photonics has highlighted increased R&D allocations for quantum well device fabrication, reflecting the sector’s focus on innovation and process scaling.

The Asia-Pacific region, notably driven by semiconductor manufacturing powerhouses such as Samsung Electronics and Samsung Semiconductor, continues to be a primary hub for QWPD production and technology development. Recent capacity expansions and the adoption of advanced molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) techniques are enabling finer control of quantum well structures, directly impacting device yields and cost structures.

While precise market size figures are closely guarded by manufacturers, sector data released by Hamamatsu Photonics and Thorlabs suggest year-on-year growth rates in the high single to low double digits for quantum well and multi-wavelength photodetector sales through 2025. This momentum is expected to sustain through at least 2030, fueled by the proliferation of 5G/6G infrastructure, autonomous vehicle LiDAR, and quantum communication systems.

- By 2030, the QWPD manufacturing market is projected to see compounded annual growth rates (CAGR) in the 8–12% range, depending on end-use segment and regional adoption rates.

- Continuous process optimization, particularly in wafer uniformity and defect control, remains a core focus for all major players, with ongoing investments in cleanroom facilities and in-line metrology.

- Collaborations between device manufacturers and photonic integration companies, such as those between Hamamatsu Photonics and system integrators, are likely to drive both volume and application diversification.

With these factors in play, the outlook for wavelength-quantum well photodetector manufacturing through 2030 is characterized by steady expansion, technological refinement, and broadening market penetration across both legacy and cutting-edge optical domains.

Key Players & Recent Partnerships: Leaders in Innovation

The landscape of wavelength-quantum well photodetector manufacturing is being shaped by a select group of industry leaders, each leveraging advanced semiconductor technologies to address demands in telecommunications, medical imaging, defense, and quantum information systems. In 2025, the sector is characterized by strategic partnerships, expansion initiatives, and a focus on improving efficiency, sensitivity, and scalability of quantum well photodetector (QWPD) devices.

- IQE plc continues to be a pivotal supplier of compound semiconductor wafers, enabling high-performance quantum well structures. The company’s 2024 expansion of its Newport, UK facility is set to boost production capacity for sophisticated photonic devices, including QWPDs, supporting customer requirements for next-generation optical components (IQE plc).

- Hamamatsu Photonics remains at the forefront of photodetector innovation, including quantum well-based and multi-wavelength detectors. The company has recently invested in R&D for extending the spectral response and miniaturization of devices for integration into compact, high-precision modules, with new product lines being announced in late 2024 and early 2025 (Hamamatsu Photonics).

- II-VI Incorporated (now part of Coherent Corp.) has been expanding its quantum well epitaxy and detector fabrication capabilities. The integration with Coherent has amplified the company’s ability to address markets such as LiDAR and datacom, with recent partnerships targeting scalable production of InGaAs-based quantum well photodetectors for broadband and infrared applications (Coherent Corp.).

- VIGO Photonics specializes in high-speed and high-sensitivity quantum well infrared photodetectors (QWIPs). In 2025, VIGO announced new collaborations with European and Asian system integrators to tailor photodetectors for hyperspectral imaging and environmental monitoring, building on its expertise in custom detector solutions (VIGO Photonics).

- Teledyne Judson Technologies, a division of Teledyne Technologies Incorporated, has advanced its production of quantum well infrared photodetectors, supporting both defense applications and scientific instrumentation. The company has recently secured defense contracts focused on multi-wavelength detection arrays and integrated sensor modules.

Looking ahead, the outlook for 2025 and beyond is defined by increased cross-sector partnerships, further investment in wafer-scale manufacturing, and a push towards integrated photonic platforms. These efforts are expected to accelerate the deployment of quantum well photodetectors in commercial, security, and environmental sensing markets, solidifying the roles of established leaders and opening opportunities for innovative new entrants.

Breakthroughs in Quantum Well Photodetector Design and Materials

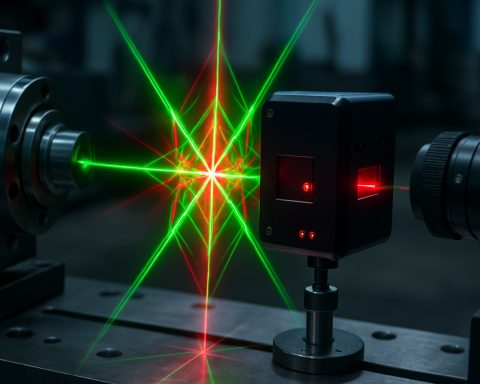

Quantum well photodetectors (QWPs) have seen rapid advances in design and materials, particularly in the context of manufacturing processes tailored for specific wavelength sensitivities. As we move into 2025, manufacturers are focusing on scalability, spectral range extension, and device integration for applications spanning telecommunications, environmental monitoring, and quantum technologies.

A notable trend is the refinement of molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) techniques for constructing multi-quantum well (MQW) structures with nanometer-scale precision. These techniques allow for the fabrication of quantum wells using materials such as InGaAs/InAlAs and GaAs/AlGaAs, optimizing absorption profiles in the mid-infrared and terahertz wavelength regimes. IQE plc, a leading epitaxial wafer producer, recently expanded its capabilities in compound semiconductor MBE, addressing growing demand for advanced photodetector structures in both defense and commercial sectors.

Material innovation is also accelerating. For example, Hamamatsu Photonics is deploying custom superlattice structures to achieve higher responsivity in discrete wavelength bands, enabling next-generation infrared imaging and spectroscopy. Their process improvements have reduced defect densities and enhanced carrier mobility within quantum wells, yielding devices with improved signal-to-noise ratios.

On the integration side, leading sensor manufacturer Leonardo S.p.A. has demonstrated wafer-scale alignment of QWP arrays compatible with silicon readout integrated circuits (ROICs), a crucial step for scalable, cost-effective focal plane arrays. This integration is propelling the adoption of QWPs in high-resolution imaging systems for aerospace and security applications.

Looking ahead, several manufacturers are exploring the deployment of new material systems such as GaN/AlGaN for ultraviolet quantum well photodetectors, aiming for commercial viability by 2027. The focus is on achieving high quantum efficiency at shorter wavelengths, where traditional materials underperform. This is complemented by ongoing collaboration between device makers and substrate suppliers to minimize threading dislocations and optimize lattice matching for large-area production.

In summary, quantum well photodetector manufacturing in 2025 is characterized by advanced epitaxial growth, novel material stacks, and improved process integration. These breakthroughs position QWPs as a versatile platform for wavelength-specific detection, with continued progress expected as manufacturers invest in both mid-infrared and ultraviolet device technologies.

Manufacturing Processes: Advancements & Cost Reduction Strategies

The manufacturing of wavelength-quantum well photodetectors (QWPDs) is experiencing marked advancements in 2025, particularly with an emphasis on process optimization, scalability, and cost reduction. Quantum well photodetectors leverage thin layers of semiconductor materials—often III-V compounds such as InGaAs/InP or AlGaAs/GaAs—engineered at the nanoscale to achieve tunable spectral sensitivity, high responsivity, and fast response times.

A central trend is the adoption of advanced epitaxial growth techniques. Metal-organic chemical vapor deposition (MOCVD) and molecular beam epitaxy (MBE) remain foundational, but recent improvements have focused on tighter thickness control and reduced defect densities, which translate into higher device yields and performance consistency. For instance, ams-OSRAM and Hamamatsu Photonics both report implementing in-situ monitoring and real-time feedback in their MOCVD processes, enabling uniform quantum well thickness across large wafer diameters and reducing costly rework.

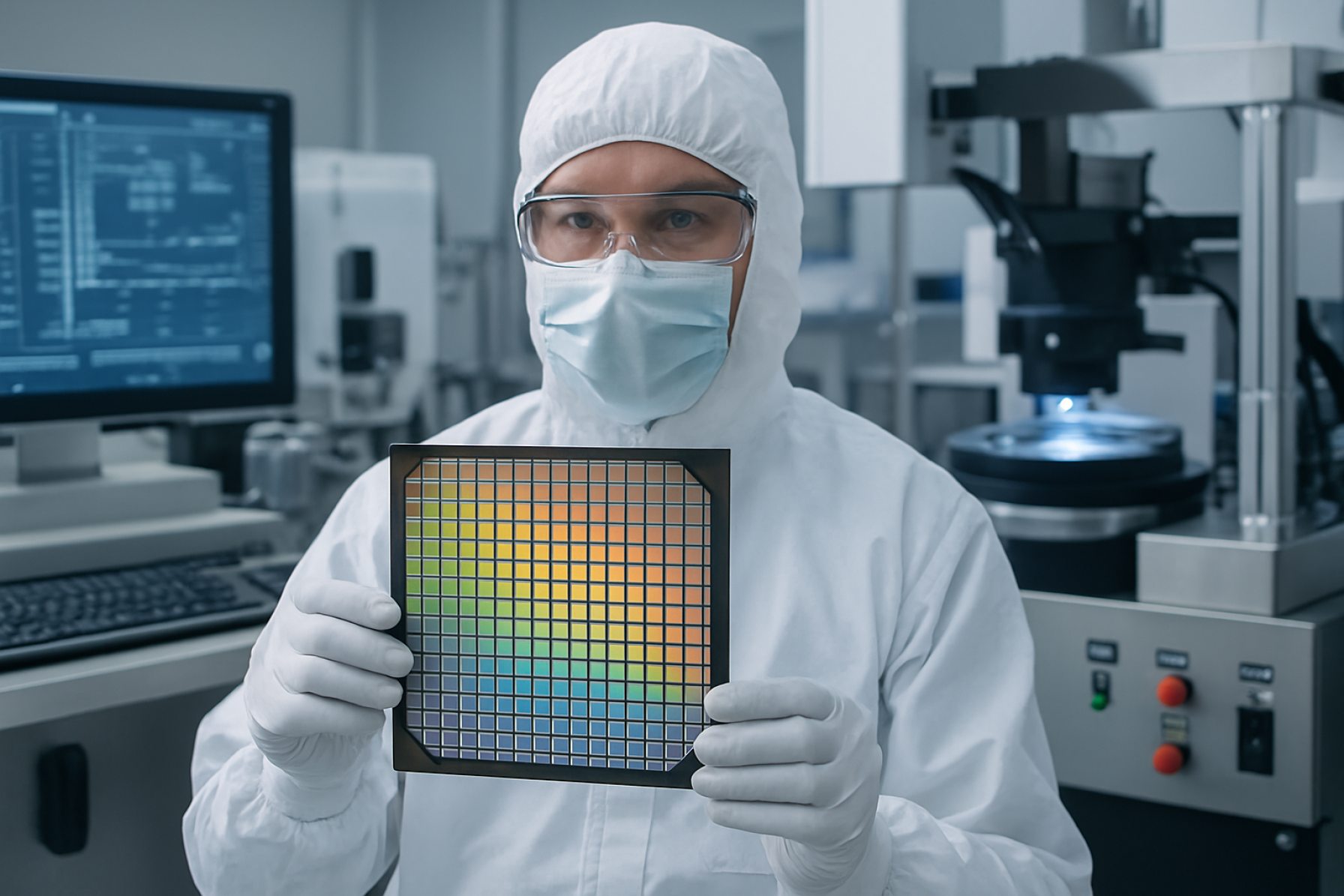

Wafer size scaling is another area of focus. Moving from 3-inch to 6-inch and even 8-inch wafers is underway at several manufacturers, with IQE plc highlighting the completion of 6-inch III-V epitaxy lines intended for photodetector and laser device markets. This scaling reduces per-device cost via higher throughput and improved economies of scale.

Monolithic integration with silicon is also advancing, addressing both performance and cost. Companies like imec are developing processes to directly integrate III-V quantum well stacks onto silicon wafers, leveraging mature CMOS foundry infrastructure to mass-produce photodetectors with complex on-chip circuitry, thereby reducing packaging and testing costs.

On the device fabrication front, automated photolithography, dry etching, and atomic layer deposition are increasingly adopted for precise patterning and passivation of quantum well structures. Vixar Inc., for example, has invested in high-volume, automated assembly lines to support the production of quantum well photonic devices for automotive and consumer applications.

Looking ahead, manufacturers are prioritizing sustainability and yield improvement through defect reduction, process recycling, and energy-efficient epitaxy. With end-user applications in automotive LiDAR, medical imaging, and fiber-optic communications driving demand, further cost reductions are expected as these advanced manufacturing processes reach maturity. The ongoing collaboration between material suppliers and device makers is accelerating the adoption of new materials—such as antimonide-based quantum wells—for extended wavelength detection, broadening the scope and competitiveness of QWPD technology in global photonics markets.

Application Spectrum: Telecom, Medical, Automotive, and Beyond

Wavelength-quantum well photodetectors (QWPs) continue to gain traction across an expanding array of applications in 2025, driven by their tunable spectral response, high quantum efficiency, and compatibility with established semiconductor processes. Key sectors—telecommunications, medical diagnostics, and automotive sensing—are leveraging advancements in QWP manufacturing to meet rising demands for sensitivity, integration, and cost-effectiveness.

In telecommunications, QWPs are pivotal for high-speed optical communication systems operating at critical wavelengths (1.3–1.55 μm). Manufacturers such as Coherent Corp. and Hamamatsu Photonics are advancing multi-quantum well (MQW) photodiode arrays, emphasizing low dark current and high bandwidth performance tailored for coherent receiver modules and photonic integrated circuits. The integration of QWPs on indium phosphide (InP) and silicon platforms is facilitating scalable transceiver production and improved energy efficiency for next-generation data centers and 5G/6G infrastructure.

In medical technology, QWPs are enabling breakthroughs in non-invasive diagnostics and imaging. The capability to engineer quantum wells for specific mid-infrared (MIR) and near-infrared (NIR) absorption bands underpins applications such as pulse oximetry, tissue spectroscopy, and fluorescence imaging. First Sensor AG and Hamamatsu Photonics are actively scaling up the manufacture of quantum well-based photodetectors with tailored wavelength selectivity and miniaturized form factors, supporting wearable and point-of-care medical devices.

Automotive applications are rapidly adopting QWPs for advanced driver-assistance systems (ADAS) and lidar. Quantum well structures, optimized for the eye-safe 1.55 μm wavelength, deliver high sensitivity and fast response times crucial for object detection and 3D mapping. Companies like Hamamatsu Photonics are supplying robust, automotive-grade quantum well photodiodes for integration into lidar modules, bolstering the safety and reliability of autonomous vehicles.

Looking forward, the continued evolution of metalorganic chemical vapor deposition (MOCVD) and molecular beam epitaxy (MBE) techniques is expanding the manufacturability of QWPs at wafer scale, reducing unit costs and enabling heterogeneous integration. Efforts by manufacturers such as ams OSRAM to combine QWP arrays with CMOS readout circuits are anticipated to accelerate adoption in emerging fields—environmental monitoring, quantum imaging, and industrial automation—over the next several years. The trajectory for QWP manufacturing in 2025 and beyond promises broader spectral coverage, enhanced device integration, and a robust pipeline of innovation across core and adjacent markets.

Supply Chain Analysis: From Wafer Fabrication to Module Assembly

The supply chain for wavelength-quantum well photodetector (QWP) manufacturing in 2025 is characterized by a tightly integrated sequence of specialized steps—from wafer fabrication through to module assembly—driven by advances in compound semiconductor processing and increasing end-market demand for high-performance detectors in telecommunications, sensing, and imaging applications.

At the foundation of the QWP supply chain is epitaxial wafer production, typically involving III-V semiconductor materials such as InGaAs, InP, or GaAs. Leading suppliers like ams OSRAM and IQE plc are expanding their molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) capabilities to deliver highly uniform quantum well structures with precise wavelength selectivity. As of 2025, these suppliers report investments in new reactor lines and tighter in-line metrology, crucial for scaling to 6-inch and even 8-inch wafer formats, which boosts throughput and cost efficiency.

After epitaxial growth, wafer processing—including photolithography, etching, metallization, and passivation—is performed in cleanroom environments. Companies such as VERTILAS GmbH and TRIOPTICS (for process control and metrology) have adopted advanced stepper lithography and atomic layer deposition to achieve the nanoscale accuracy required for multi-quantum well layer definition. Yield optimization at this stage is a key focus, with manufacturers reporting integration of machine vision and AI-based defect detection to reduce scrap rates and enhance device reliability.

Die singulation and device packaging form the next critical step, with packaging houses like ams OSRAM and Hanwha Solutions offering turnkey services for the mounting and hermetic sealing of QWP chips. Packaging trends in 2025 emphasize miniaturization and thermal management, with flip-chip bonding and advanced ceramic or silicon submounts increasingly adopted to support high-frequency operation and robust field deployment.

Final module assembly integrates QWP devices into photodetector modules, often co-packaged with other optoelectronic components. Major system integrators such as Hamamatsu Photonics and Lumentum are leveraging automated optical alignment and robotic assembly lines to support growing volumes and tighter performance tolerances, especially for 5G, data center, and automotive LiDAR applications.

Looking ahead, suppliers anticipate increased vertical integration and regional diversification of the QWP supply chain, prompted by both geopolitical considerations and the need for supply security. Collaborative efforts between wafer foundries, packaging specialists, and end-users are expected to drive further process innovation, yield improvement, and shorter time-to-market for next-generation QWP modules over the next several years.

Regulatory Environment & Industry Standards (Referencing ieee.org)

The regulatory environment and industry standards for wavelength-quantum well photodetector (QWP) manufacturing are rapidly evolving to accommodate significant advancements in optoelectronics, particularly as demand grows in telecommunications, environmental monitoring, and infrared imaging. As of 2025, global regulatory alignment and standardization efforts are being spearheaded by recognized industry bodies, with the IEEE (Institute of Electrical and Electronics Engineers) playing a pivotal role in defining technical benchmarks.

IEEE standards, such as those set forth by the IEEE Photonics Society, provide guidance on photodetector performance metrics, testing procedures, and device interoperability. These standards address key parameters including spectral response, noise characteristics, quantum efficiency, and reliability, ensuring that QWP devices meet rigorous performance and safety criteria. The IEEE’s ongoing work in this area is critical, as manufacturers seek to ensure that their products are both globally competitive and compliant with international expectations.

In 2025, regulatory frameworks are increasingly harmonized with these standards, particularly in regions where optoelectronic components play a vital role in critical infrastructure. For instance, the European Union’s directives on RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) are influencing material choices in QWP manufacturing, pushing companies to adopt cleaner processes and alternative materials wherever possible. U.S. regulatory agencies, in turn, are collaborating with industry to streamline approval pathways for new photodetector devices, leveraging IEEE standards for technical validation.

This regulatory momentum presents both opportunities and challenges for manufacturers. On the one hand, companies that align their processes with IEEE and regional requirements can access broader markets and participate in global supply chains. On the other, the need for compliance drives up initial R&D and production costs, particularly as standards around device miniaturization and integration with CMOS platforms become more stringent.

Looking forward, the next few years are expected to bring more granular standards specific to wavelength-quantum well photodetectors, reflecting emerging use cases such as quantum communication and advanced hyperspectral imaging. The IEEE, in collaboration with industry stakeholders, is anticipated to release updated protocols that address new materials systems (e.g., III-V semiconductors on silicon) and hybrid integration techniques, further shaping the regulatory landscape and fostering innovation in the field.

Investment Trends, M&A, and Funding Opportunities

Investment in wavelength-quantum well photodetector (QWP) manufacturing has accelerated in 2025, reflecting both expanding application spaces and demand for higher performance optoelectronic devices. These photodetectors, which exploit quantum confinement effects to achieve selective wavelength sensitivity, are increasingly vital in fields such as spectroscopy, telecommunications, and infrared imaging. The surge in interest is driving capital inflows, partnerships, and targeted acquisitions across major industry players and emerging startups.

A notable trend in 2025 is the strategic acquisition of niche manufacturers and technology licensors specializing in advanced epitaxial growth and wafer processing. For example, ams OSRAM has expanded its photonic components portfolio through investments in III-V compound semiconductor fabrication, aiming to strengthen its position in high-sensitivity quantum well photodetectors for automotive and industrial markets. Similarly, Hamamatsu Photonics has announced increased R&D funding for next-generation QWP architectures, with a focus on integration into multi-element sensor arrays for hyperspectral imaging and optical communications.

In terms of funding, several startups have secured Series B and C rounds to scale up production and commercialize new QWP designs. Vixar, a subsidiary of Osram, has reported significant expansion of its manufacturing capabilities, targeting the mid-infrared QWP market for gas sensing and environmental monitoring applications. Meanwhile, II-VI Incorporated (now part of Coherent Corp.) has leveraged both organic investment and strategic partnerships to advance its epitaxial wafer production for QWP and related photodetector technologies, emphasizing cost-effective scalability and yield improvements.

The competitive landscape is further shaped by joint ventures and consortia focused on developing vertically integrated supply chains for quantum well devices. For instance, SEMI, the global industry association, has facilitated collaborative initiatives among leading photonics manufacturers, materials suppliers, and research institutions to address process standardization and reliability testing—key factors for attracting institutional and corporate investors to the field.

Looking ahead to the next few years, continued growth in investment is expected, driven by the proliferation of applications requiring precise wavelength discrimination and high-speed operation. Government funding is also likely to play a role, especially for defense and space-related programs utilizing advanced QWP arrays for sensing and imaging. As manufacturing capabilities mature and economies of scale are realized, further mergers and acquisitions are anticipated, particularly among mid-sized foundries seeking to expand their quantum well technology portfolios and global reach.

Future Outlook: Technological Roadmaps & Competitive Landscape

The manufacturing landscape for wavelength-quantum well photodetectors (QWPDs) is poised for significant advancements in 2025 and the subsequent years, driven by rapid innovation in materials science, epitaxial growth techniques, and integration with advanced electronic and photonic systems. As demand for high-performance photodetectors in telecommunications, sensing, and imaging applications continues to rise, manufacturers are refining their processes to achieve higher sensitivity, broader wavelength selectivity, and improved device miniaturization.

Key industry players are investing in advanced epitaxial growth methods such as molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD) to enhance quantum well uniformity and interface quality. For example, Coherent Corp. (formerly II-VI Incorporated) and Lumentum are scaling up their MOCVD and MBE capabilities to meet rising demand for high-volume, high-quality photodetector wafer production, particularly for telecom wavelengths (1.3–1.55 μm) and emerging mid-infrared sensing markets.

Material system innovation remains a focal point, with companies like Hamamatsu Photonics and ams-OSRAM advancing the use of InGaAs, InP, HgCdTe, and even novel III-nitride alloys to extend detection ranges into the short-wave and mid-infrared. These efforts are complemented by advances in wafer bonding and hybrid integration, enabling monolithic and heterogeneous assembly of photodetectors with electronics and silicon photonic circuits—a priority for Intel and Teledyne Technologies as they target datacom and imaging markets.

Looking ahead, the competitive landscape is expected to intensify as foundries and vertically integrated companies alike pursue cost-effective scaling. Outsourced semiconductor assembly and test (OSAT) providers such as Amkor Technology are increasingly participating in the packaging of quantum well photodetectors, enabling more compact, thermally robust, and application-specific solutions.

Industry roadmaps for 2025–2027 anticipate continued miniaturization, with pixel pitches for imaging arrays shrinking below 10 μm, and further integration with on-chip readout electronics. There is also strong momentum toward eco-friendly and lead-free manufacturing, responding to regulatory and customer pressures. As manufacturing ecosystems evolve, strategic collaborations between material suppliers, foundries, and device integrators will be crucial for meeting the high-performance and reliability standards required in next-generation photonics applications.

Sources & References

- Hamamatsu Photonics

- VIGO Photonics

- AIT Austrian Institute of Technology

- Thorlabs

- Samsung Semiconductor

- IQE plc

- Coherent Corp.

- VIGO Photonics

- Teledyne Technologies Incorporated

- Leonardo S.p.A.

- ams-OSRAM

- imec

- First Sensor AG

- VERTILAS GmbH

- TRIOPTICS

- Lumentum

- IEEE (Institute of Electrical and Electronics Engineers)

- Teledyne Technologies

- Amkor Technology