- The U.S. imposed a 50% tariff on Chinese imports in April 2025, affecting both stock and crypto markets.

- Bitcoin dropped to $74,500, and Ethereum plunged by over 20%, demonstrating the impact on digital currencies.

- Trump’s 90-day tariff reprieve offered some recovery, with Bitcoin and Ethereum regaining losses by April 18.

- Tariffs heighten economic uncertainty, inflame inflation, and deter investment in riskier assets like cryptocurrencies.

- S&P 500 and Nasdaq declines highlight growing ties between equity and crypto markets.

- Federal Reserve Chair Powell noted tariffs’ impact on monetary policy challenges.

- Bitcoin ended mid-April at $84,704.44, Ethereum at $1,595.26, indicating partial recovery.

- Experts like Michael Saylor emphasize crypto’s resilience, while others predict volatile shifts.

- Investors should diversify, stay informed, and focus on long-term strategies amid ongoing economic dialogues.

The air was thick with tension in the financial world as the U.S. unleashed a fresh volley of tariff announcements. Cryptocurrencies—often seen as the digital canaries in the fiscal coal mine—shuddered in response. This correlation isn’t new, but the recent upheavals have spotlighted just how intricately woven together traditional economic policies and digital currencies have become.

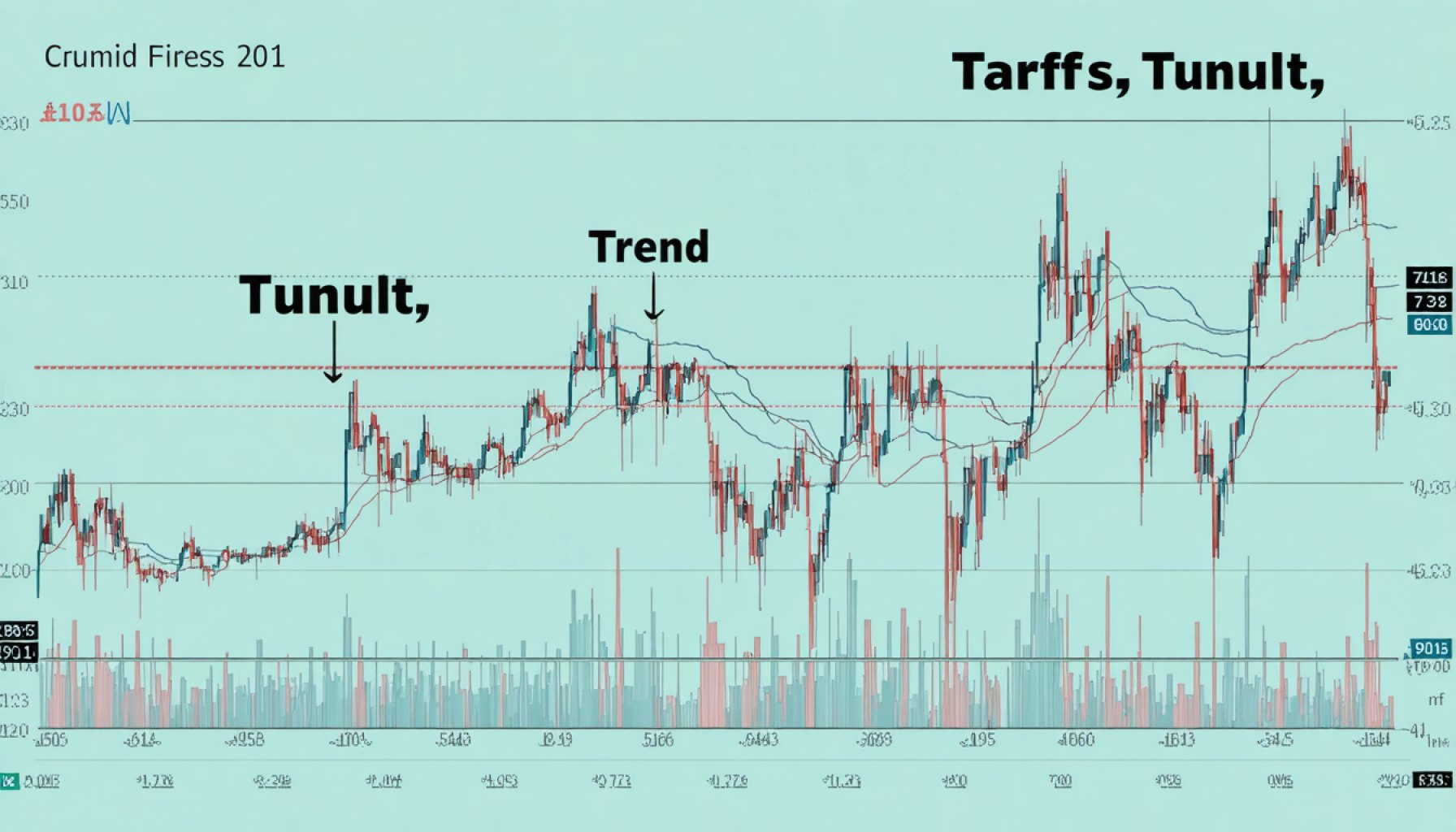

When President Trump announced a draconian 50% tariff on Chinese imports early in April 2025, it wasn’t just the stock markets that reeled. Bitcoin tumbled to $74,500, while Ethereum suffered a gut-wrenching fall of over 20%. Investors, breathless and bewildered, scrambled to make sense of this sharp financial dip.

Yet, amidst despair came a flicker of hope. On April 9, Trump granted a temporary reprieve by pausing most tariffs for 90 days. This move was akin to applying a balm to burn—a reprieve that brought some stability back, allowing Bitcoin and Ethereum to claw back previous losses by the time April 18 dawned.

Why such intense reactions? For one, tariffs are notorious for inflaming economic uncertainty. They hold the potential to escalate inflationary pressures and impair growth, casting an ominous shadow on investor appetite for riskier assets like crypto. Moreover, the relationship between equities and cryptocurrencies has grown stronger, as evidenced by the synchronized declines that battered both the S&P 500 and the Nasdaq.

Adding to the anxiety, Federal Reserve Chair Jerome Powell remarked that tariffs complicated the already delicate dance of monetary policy, sending ripples through the investor community. Bitcoin prices, pivoting constantly with these shifts in sentiment, became barometers of broader economic anxiety.

By April 18, the crypto landscape remained fraught with uncertainty. Bitcoin hovered at $84,704.44, and Ethereum settled at $1,595.26—indicators of recovery, yet still below their past zeniths. Meanwhile, altcoins like Solana saw renewed interest, demonstrating the increasingly diverse nature of the crypto ecosystem.

In this volatile atmosphere, expert opinions were as varied as the market’s mood. Shrewd optimists like Michael Saylor clung to Bitcoin’s decentralized promise as a sanctuary immune to tariffs, while others like Anthony Pompliano predicted a rebound to unparalleled heights by year-end. Dave Portnoy and Adin Ross, however, personified the risks, recounting tales of millions lost amidst the turmoil.

The overarching narrative here is clear: crypto markets in 2025 are walking a tightrope, poised between opportunity and peril. With the Federal Reserve’s next moves and the ongoing dance of tariff negotiations, every decision casts ripples across both digital and traditional financial landscapes.

Amid this uncertainty, investors are advised to sharpen their strategies. They must remain abreast of the evolving economic dialogues, diversify portfolios, and maintain a long-term outlook, especially with Bitcoin’s anticipated halving.

As talks continue behind the closed doors of boardrooms and government offices, the message is unmistakable—economic policies are no longer a distant phenomenon for the crypto world. They inform every trade, every investment decision, and ultimately, the pulse of technology-driven financial markets.

Brace Yourself: Navigating the Tumultuous Waters of Crypto and Tariffs

Understanding the Crypto Market’s Response to Tariffs

When President Trump announced a 50% tariff on Chinese imports in April 2025, both traditional and digital markets reacted sharply. Cryptocurrencies like Bitcoin and Ethereum faced significant volatility, highlighting the deeply intertwined nature of economic policies and digital assets.

Why Do Tariffs Impact Cryptocurrencies?

1. Economic Uncertainty: Tariffs create unpredictability, impacting investor sentiment. The financial world becomes anxious about inflation, thereby affecting risk appetite.

2. Correlation With Equities: As cryptocurrencies become more mainstream, their movements increasingly mirror those of traditional markets like the S&P 500 and Nasdaq.

3. Federal Reserve Policy: Comments from figures like Federal Reserve Chair Jerome Powell can sway markets. Tariffs complicate policy decisions further, adding another layer of tension.

To dive deeper into economic theories and trends, explore Federal Reserve.

Detailed Market Observations

– Bitcoin and Ethereum: After initial drops, both currencies partially recovered following a 90-day tariff reprieve. They stood at $84,704.44 (Bitcoin) and $1,595.26 (Ethereum) by April 18, 2025.

– Altcoins: Coins like Solana demonstrated resilience, showing the potential for diversification beyond leading cryptocurrencies.

Insights from Experts

– Optimistic Views: Michael Saylor remains a strong proponent of Bitcoin’s potential as a non-correlated asset to traditional economic woes.

– Pessimistic Takes: Figures like Dave Portnoy recall significant financial losses, underscoring the associated risks.

– Market Predictions: Analysts like Anthony Pompliano foresee potential rebounds, emphasizing the unpredictable yet promising landscape.

For further insights on market predictions, visit CoinMarketCap.

Strategies for Navigating Crypto Volatility

1. Stay Informed: Track economic policies and central bank communications closely.

2. Diversify Portfolios: Consider broadening investments to include a mix of cryptos and traditional assets.

3. Adopt a Long-Term Outlook: Volatility may present opportunities—keeping a long-term perspective can cushion against interim fluctuations.

Real-World Use Cases and Future Trends

1. Risk Management: Sophisticated investors leverage futures and options in crypto to hedge against market swings.

2. Global Adoption: As blockchain technologies gain traction, expect regulatory landscapes to evolve, impacting both risks and opportunities.

To learn more about blockchain technologies and their real-world applications, visit IBM Blockchain.

Concluding Recommendations

– Analytics Tools: Utilize platforms offering crypto analytics to make informed investment decisions.

– Community Engagement: Engage with crypto communities and forums for real-time updates and peer insights.

– Continuous Learning: Educate yourself on emerging blockchain technologies to stay ahead of the curve.

As volatility persists, these strategies can help investors better navigate the uncertain waters of the 2025 crypto market. In a world where economic policy and digital assets increasingly collide, being prepared and informed is more important than ever.